https://vooglue.io/wp-content/uploads/2018/05/30741306_10214334783576434_2980798309683242139_n.jpg

720

960

admin

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

admin2018-04-30 04:06:332018-05-04 04:15:22VooGlue Presents At Cryto Secrets Forum

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

0

0

Graham Stone

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

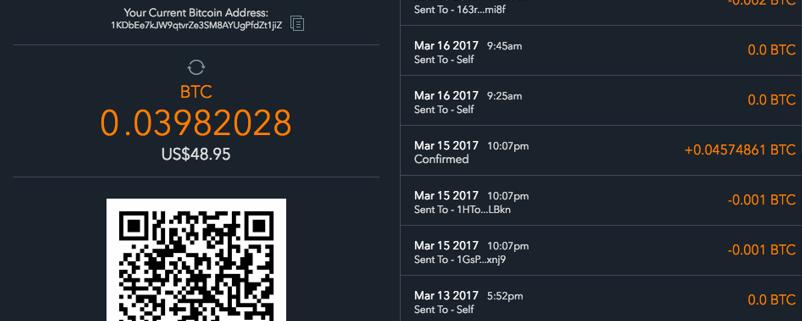

Graham Stone2018-02-28 11:44:472018-05-04 06:35:09How to Buy VooGlue (VGC) Tokens

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

0

0

Graham Stone

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

Graham Stone2018-02-10 06:31:122018-02-15 07:21:24VooGlue Token Sale Registers 1,000 Buyers

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

0

0

Graham Stone

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

Graham Stone2018-01-23 12:34:032018-01-23 12:35:05VooGlue’s Token Pre-Sale Begins

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

0

0

Graham Stone

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

Graham Stone2018-01-22 09:39:222018-01-22 09:41:10How to Avoid Scams When Investing in ICO's

https://vooglue.io/wp-content/uploads/2018/01/hvfgh.png

499

802

Ratko Stambolija

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

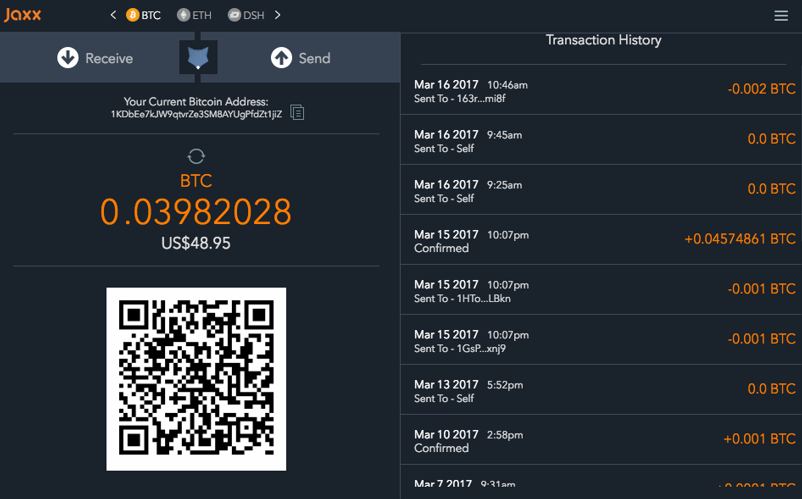

Ratko Stambolija2018-01-11 12:18:292018-01-11 12:18:29Entering the Cryptocurrency Ecosystem

https://vooglue.io/wp-content/uploads/2018/01/panoramic-3049543_1920.jpg

895

1920

Ratko Stambolija

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

Ratko Stambolija2018-01-04 08:24:132018-01-05 15:59:48The Basics of Blockchain Technology and Token Sales