Entering the Cryptocurrency Ecosystem

Making an Initial Purchase

Bitcoin and other cryptocurrencies can be purchased in many ways but the majority of purchases and trades today occur on centralized exchanges. Entering the cryptocurrency ecosystem can be a little confusing. Once you have changed (fiat) cash into cryptocurrency, however, it becomes much easier to transfer from one currency to another. Most people enter the ecosystem by purchasing Bitcoin, as it has the most widely available options for purchase.

The following is a summary of ways to buy Bitcoin:

ATMs

In most major cities there now exist a growing network of Bitcoin ATMs. To buy from an ATM you first need to create a “wallet” (see below), then insert cash into the machine. The machine then sends the purchased Bitcoin to your wallet.

Peer-to-Peer and In Person

It’s possible to actually physically meet a person, hand over cash, and receive the “keys” to purchased bitcoin, although this is rarely done in nowadays in developed countries. To purchase bitcoin in person you would confirm that the bitcoin has actually been deposited in your personal “wallet” before leaving/handing over the cash.

Peer to Peer Online

The next way is to find a seller online and purchase directly from that seller. The most popular site for this is localbitcoins. This site allows you to find people who are willing to accept cash transfers in exchange for bitcoin. In this case trust is established through reputation, so if you see that the seller has a high rating on the site, you can expect to actually receive the bitcoin once your money has been transferred to their account.

Using localbitcoins is more popular in countries that don’t have legal Bitcoin exchanges.

By Exchange with Cash Transfer

In order to improve convenience and reliability over the above two options, centralized Bitcoin exchanges have been established. In this case you must trust the reputation of the exchange. After the Mount Gox scandal of 2014, and in response to investigations relating to money laundering and the use of bitcoin in criminal activity, exchanges became more regulated starting in 2014. Know Your Customer (KYC) and Anti-Money Laundering (AML) policies were established so that before you can deposit dollars or any other fiat currency to one of these centralized exchanges, you now must submit personal documents to verify your identity. This process usually takes between a day and two weeks, and for some exchanges may involve extra security measures such as the receipt of a confirmation code to your home address.

Once you are approved with an exchange, you can transfer your fiat currency directly from your bank. When the currency has been accepted by the exchange, you can purchase bitcoin at the rates listed on your exchange. Bitcoin purchased on an exchange is held in a wallet created for you by the exchange. It’s worth noting that in this situation, the exchange technically has access to your Bitcoin in addition to you.

By exchange with Credit Card

A growing list of exchanges now allow small purchases of bitcoin with the use of an approved credit card. This process can be slightly faster and more convenient than the above cash transfer process but still requires some form of verification and generally results in higher fees. If you plan on purchasing a small amount of bitcoin, this is probably the fastest, easiest, and most familiar way (if you already have a credit card).

Trading Between Cryptocurrencies

Centralized Exchanges

Once you have moved fiat cash into the cryptocurrency ecosystem, it becomes significantly easier to exchange between currencies. This can be done instantly within centralized trading exchanges like Coinbase, Bittrex, Kraken and Binance.

Decentralized Exchanges

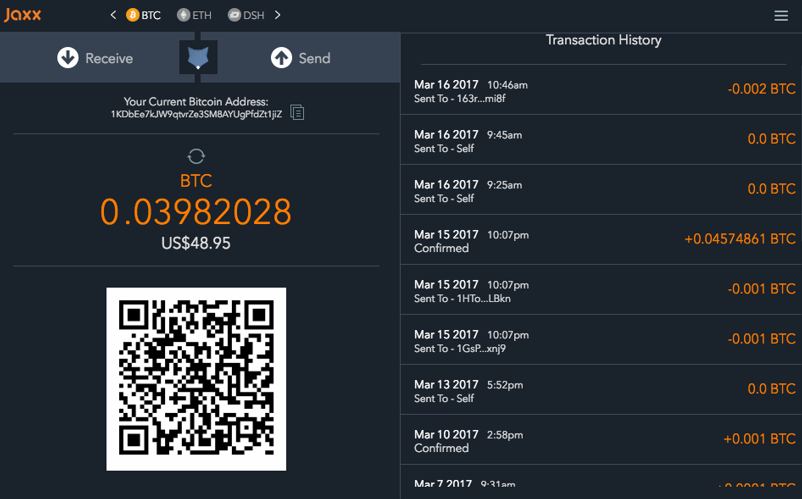

Trading can also be done through decentralized exchanges like Shapeshift, which is built into the user interface of popular wallet applications like Jaxx, allowing you to instantly switch between supported cryptocurrencies within your own wallet. Completely decentralized exchanges that look like traditional trading platforms (with order books and price history) like Etherdelta have already begun, with many other exchanges planning to build or switch to the decentralized model. In the decentralized model, tokens are held in smart contracts until orders are matched. This means there is no chance of the exchange suddenly “going bankrupt” or otherwise disappearing with your tokens.

Wallets and Storage

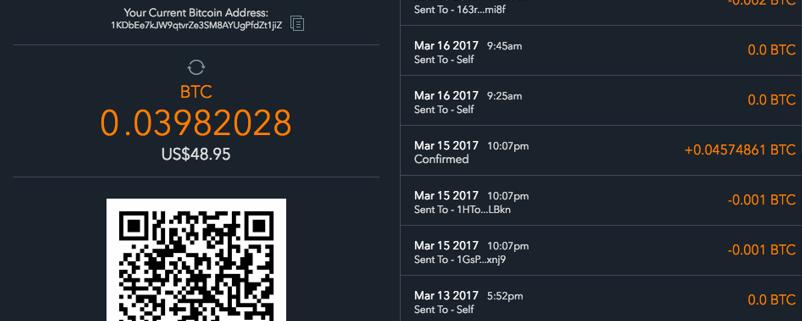

A bitcoin or cryptocurrency wallet is, as the name suggests, a place to store your bitcoin or cryptocurrency.

It’s easy (and free) to make a wallet, but the security of wallet you need to employ really depends on how much money you have in it and how comfortable you are with that amount of money.

Storing cryptocurrency securely can be a tricky endeavor for non-tech savvy investors. Therefore, most investors leave their coins in the digital wallets controlled by the online exchange where they purchased the cryptocurrency. This is akin to letting a company store your gold for you instead of storing your gold yourself. However, this is even more precarious because over a third of cryptocurrency exchanges have been hacked, and none of them offer deposit insurance.

It’s important to understand two key terms related to cryptocurrency wallets:

Public Key / Public Address:

This is like your bank account number. If you want people to send you money, this is the address you’ll give them. It looks something like this:

1CC3X2gu58d6wXUWMffpuzN9JAfTUWu4Kj3k8Dbpv

Private Key:

This is your secret code – or key – for accessing the funds in your wallet. You need this key in combination with your public key / public address if you want to move your bitcoins or a portion of them to another wallet. This key must be kept secret, safe, and secure – and this is one of the bigger challenges that newcomers to cryptocurrencies face. Your options for saving your private key range from writing it down on a piece of paper to storing it in a vault. Typical private key looks like this:

5HpHagT65TZzG1PH3CSu63k8DbpvD8s5ip4nEB3kEsreAnchuDf

For Small Amounts of Money, Convenience Is More Important for Most People:

A convenient online wallet is probably the best option for small amounts of money. These include Electrum, Mycelium, BreadWallet, and Bitcoin Wallet.

Once set up, many of these wallets don’t require you to enter your private key in order to make transactions. They are apps that trust that the holder of the device is the one with permission to use the wallet and so work conveniently like other apps on your phone or in your desktop browser.

For Larger Amounts of Money, Security Is More Important:

In this case, you’ll want to follow some best practices related to the handling of your private key.

What Not to Do with Your Private Key:

- Don’t save it on your computer.

- Don’t email it to yourself.

- Don’t type it into a website while connected to public WiFi.

The Safest Way to Store Your Private Key:

In an ideal world, you would never write your private key, not even on paper. If you trust yourself to memorize a string of characters like the one above, you are an impressive human being. If not, continue reading for your other options.

The Next Best Way to Store Your Private Key:

Write it down on paper. Put one copy in a safe in your house and the other copy in a vault in a bank. This way you’re protected unless your house burns down and the bank gets robbed at the same time.

An Additional Safety Measure:

You also have the option of dividing your key into two or more parts. This is called a multi-signature wallet. Doing this would mean that the only way access the funds would be to have both keys at the same time, thus allowing you to further diversify your risk.

If your wallet contains millions of dollars, it’s definitely worth it for you to take these steps.

Another Good Option for Storing Your Assets:

Use a “hard wallet.”

A hard wallet like the Ledger Nano S or the Trezor is a piece of hardware about the size of a USB Thumb drive that you plug into your computer’s USB port.

This is a good option because it makes accessing not only your bitcoin, but also most other cryptocurrency wallets you may have, both safe and convenient. It does this by reducing all of your passwords to a single PIN that is, in fact, possible for a normal human like to remember. This means that you’ll be able to securely access your cryptocurrency accounts without opening your safe, getting that out that paper, and typing in the complex password you’ve created.

The PIN is used to access your accounts on a daily basis but it is still backed up by a longer and more complex password. If you lose or break your hard wallet, therefore, you will still be able to access your accounts. You do this by unlocking them with a pneumonic phrase that is generated when you first turn on your hard wallet (the pneumonic phrase should be saved in the same way as your private key as described in the steps above).

Conclusion

It is estimated that at least 10% of bitcoins currently in existence are simply “lost.” This means that the owners have misplaced their private keys in some way. The internet is rife with stories of people desperately searching for lost keys, including one man who is scouring an entire landfill to find a USB containing 7,500 bitcoins.

There are have also been numerous cases of people losing their bitcoin through phishing scams and possibly malware.

Holding cryptocurrencies is akin to carrying around not just a Swiss Bank Account in your wallet, but a whole Swiss Bank. But with this great power comes great responsibility. If you handle your private keys according to the best practices outlined above, you will never lose your tokens. If you’re not careful, however, you might lose everything, and there’s no help desk to call.