https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

0

0

Graham Stone

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

Graham Stone2018-02-09 05:29:102018-02-09 05:29:10What Can We Expect from VooGlue in the Near Future?

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

0

0

Graham Stone

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

Graham Stone2018-02-09 05:26:532018-02-09 05:26:53VooGlue Bounty Campaign Kicks Off

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

0

0

Graham Stone

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

Graham Stone2018-02-09 04:59:142018-02-09 05:02:08The Meaning of “VooGlue”

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

0

0

Graham Stone

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

Graham Stone2018-01-27 08:02:322018-02-09 05:05:13VooGlue Team Shares Thoughts on Project

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

0

0

Graham Stone

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

Graham Stone2018-01-23 12:34:032018-01-23 12:35:05VooGlue’s Token Pre-Sale Begins

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

0

0

Graham Stone

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

Graham Stone2018-01-22 09:39:222018-01-22 09:41:10How to Avoid Scams When Investing in ICO's

https://vooglue.io/wp-content/uploads/2018/01/IMG_6794-500x500.jpg

500

500

Ratko Stambolija

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

Ratko Stambolija2018-01-12 08:40:522018-01-12 08:40:52Stunning Pieces of Cryptocurrency-themed Art

https://vooglue.io/wp-content/uploads/2018/01/hvfgh.png

499

802

Ratko Stambolija

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

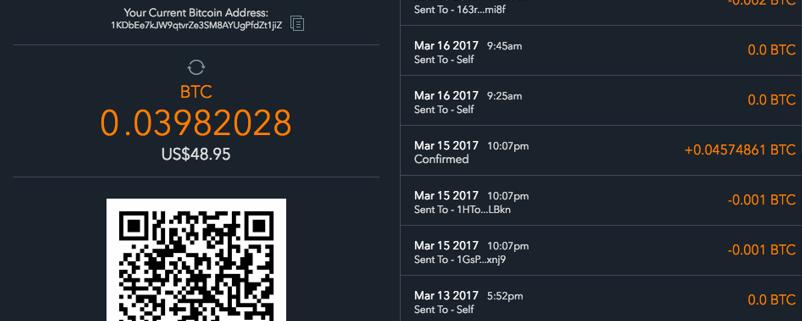

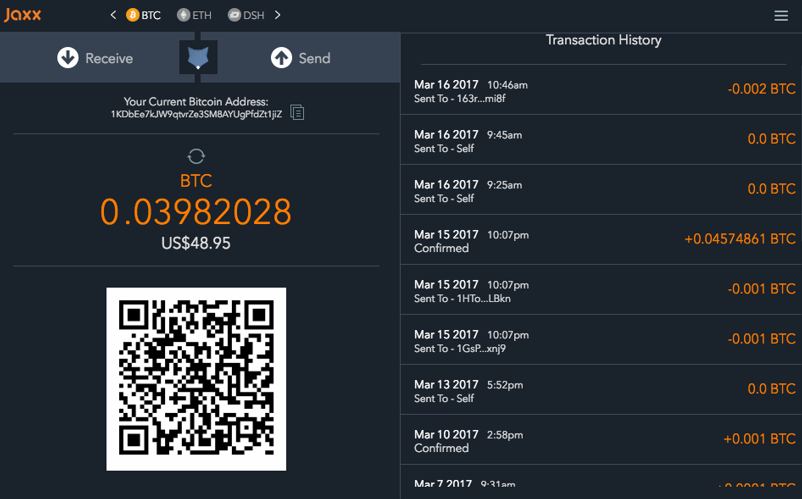

Ratko Stambolija2018-01-11 12:18:292018-01-11 12:18:29Entering the Cryptocurrency Ecosystem

https://vooglue.io/wp-content/uploads/2018/01/panoramic-3049543_1920.jpg

895

1920

Ratko Stambolija

https://vooglue.io/wp-content/uploads/2020/03/corporate-logo.png

Ratko Stambolija2018-01-04 08:24:132018-01-05 15:59:48The Basics of Blockchain Technology and Token Sales